2025 Venture Capital Industry Forecast

Executive Summary

This research report examines structural changes in the venture capital industry heading into 2025, analyzing how capital concentration among dominant firms is creating systemic inefficiencies that will accelerate the adoption of alternative models, particularly venture studios. The traditional VC model faces existential challenges that create opportunities for new approaches to early-stage innovation financing.

Key Findings

- The Power Law Cartel - a concentrated network of dominant VC firms - has emerged as the controlling force in venture capital, capturing over 50% of US fundraising in 2024

- The Cartel's investment strategies rely on artificial scarcity and market signaling to maintain control over deal flow and LP capital

- Artificial Intelligence has become the Cartel's primary narrative tool for justifying extreme portfolio concentration

- Traditional LP allocation models reinforce Cartel dynamics through "flight to scale" behavior

- The inefficiencies created by Cartel dominance are creating opportunities for alternative models, particularly venture studios

The Power Law Cartel in Venture Capital: A Framework for Understanding Market Dysfunction

In 2024, the venture capital industry crossed a significant threshold, marking a milestone highlighting the increasing consolidation of power among a select few firms.

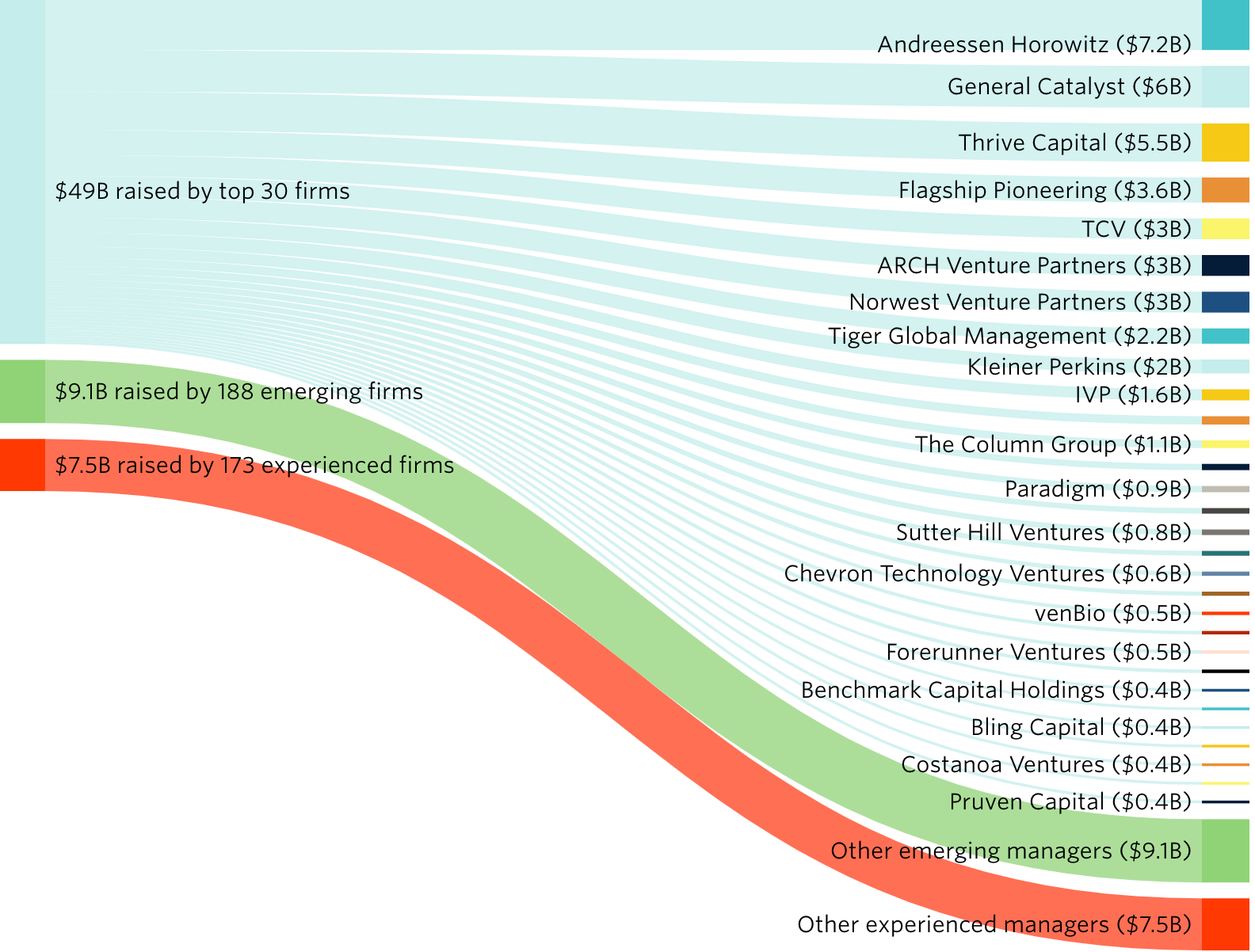

According to Pitchbook, just nine venture capital firms, led by giants like Andreessen Horowitz, captured over 50% of all U.S. venture capital fundraising.

This startling level of concentration signals not just a cyclical anomaly but a structural transformation in the VC ecosystem. The dominance of these firms exemplifies the principles outlined in our Power Law Cartel thesis, which identified that venture capital has become a closed ecosystem where a small network of players controls the majority of resources, deal flow, and narrative authority.

The Power Law Cartel thesis is rooted in the observation that the VC industry has systematically misinterpreted historical power law outcomes as a forward-looking strategy. The power law—the idea that a small number of investments drive the majority of returns—describes outcomes rather than dictating how capital should be allocated. Yet, leading firms have weaponized this statistical observation to entrench their dominance.

Cartel Tactics and Impact

The Cartel has weaponized the power law - a statistical observation about return distributions - into a forward-looking strategy that justifies extreme portfolio concentration. Tactical elements include:

- Board Control: Securing governance rights through "protective provisions"

- Valuation Management: Using signaling power to influence market prices

- Narrative Control: Shaping perceptions of what constitutes "good" investments

- Network Exclusion: Creating barriers for emerging managers and alternative models

This systematic approach has transformed venture capital from an open market for innovation into a controlled ecosystem where success increasingly depends on Cartel access and approval.

Market Dynamics Creating Change

AI as the Latest Control Mechanism

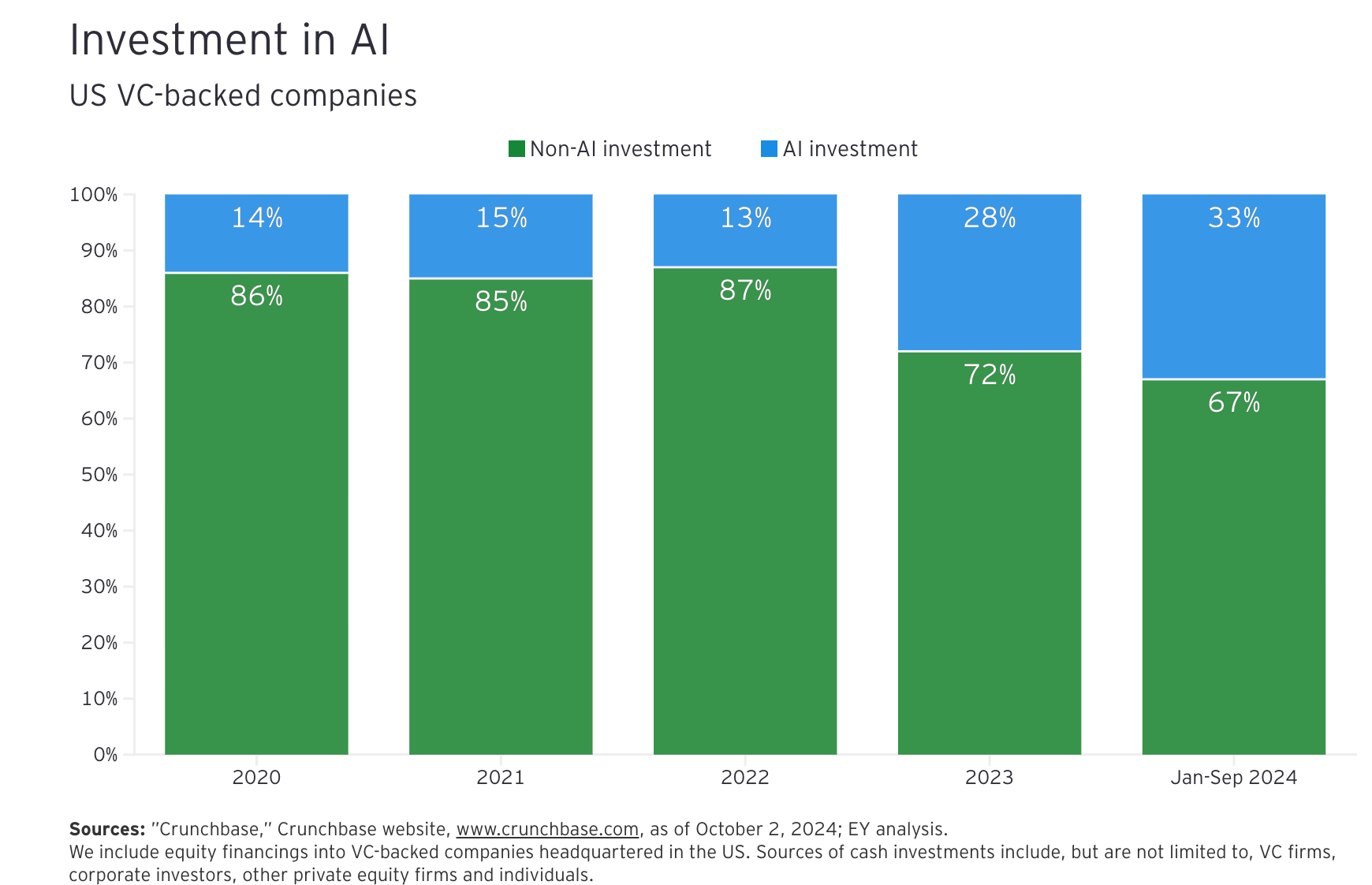

The Cartel has positioned Artificial Intelligence (AI) as its primary narrative tool for maintaining market control. During the first three quarters of 2024, investments in AI-focused AI-focused ventures captured 33% of all US VC funding through Q3 2024, up from 14% in 2020. By establishing themselves as AI "gatekeepers," dominant firms have created artificial scarcity in access to perceived premium deals.

LP Behavior and Cartel Reinforcement

Traditional limited partners have become unwitting participants in reinforcing Cartel power through:

- "Flight to scale" behavior favoring the largest managers - increasingly favoring firms with the scale and resources

- Risk-averse allocation to perceived "safe bets"

- Acceptance of Cartel narratives about AI and other themes

- Systematic exclusion of emerging managers

- Preference for simplified portfolio management through fewer, larger relationships

This behavior creates a self-reinforcing cycle where LP capital concentration strengthens Cartel control, which, in turn, attracts more LP capital.

Growing Market Inefficiencies

This concentration is creating multiple inefficiencies:

- Funding gaps in non-AI sectors

- Inflated valuations in favored sectors

- Reduced support for early-stage innovation

- Limited options for emerging managers

The Emergence of Alternative Models

Venture Studio Advantage

Venture studios are emerging as a compelling alternative to traditional VC, offering:

- Integrated operational support

- Systematic de-risking of early ventures

- Diversified revenue streams

- Focus on underserved sectors and stages

Performance Metrics

Recent research indicates venture studios are achieving superior results:

- Higher internal rates of return vs traditional VC benchmarks

- Better survival rates for portfolio companies

- More efficient capital deployment

- Stronger alignment with founder interests

2025 Market Forecast

Projected Industry Evolution

We forecast several key developments for 2025:

- Accelerated Consolidation

- Further concentration of traditional VC capital

- Continued dominance of AI thematic investing

- Growing barriers for emerging managers

- Alternative Model Growth

- Expansion of venture studio adoption

- Increased LP interest in studio models

- Emergence of hybrid financing approaches

- Market Recalibration

- Growing recognition of system inefficiencies

- Shift toward operational value-add models

- Evolution of LP allocation strategies

Strategic Implications: Breaking Cartel Control

For Traditional VCs

- Growing pressure to justify concentrated portfolio strategies

- Need to demonstrate value beyond capital and signaling

- Risk of being caught in Cartel-driven market distortions

- Challenge of maintaining returns as deal access commoditizes

For Emerging Managers

- Opportunity to bypass Cartel structures through venture studio models

- Focus on operational expertise over financial engineering

- Target systematically undervalued sectors outside Cartel focus

- Build direct relationships with founders through value-add capabilities

For Limited Partners

- Urgent need to reassess Cartel concentration risks

- Opportunity to capture alpha through alternative models

- Importance of evaluating operational capabilities over brand names

- Strategic value of supporting ecosystem diversity

- Need to develop more sophisticated portfolio construction approaches

The Great Pivot: From Capital Allocators to Venture Builders

The Emerging Manager Exodus

As the Power Law Cartel's control over LP capital allocation strengthens in 2025, we forecast a significant strategic pivot among emerging managers. Unable to compete in traditional fundraising, these managers will increasingly transition toward operationally-intensive venture studio models. This shift represents more than adaptation – it signals the beginning of a fundamental recalibration of the venture capital value chain.

From Financial Engineering to Venture Building

Data indicates venture studios already achieve superior results compared to traditional VC benchmarks:

- Higher internal rates of return (60% vs. 30% industry average)

- Better survival rates for portfolio companies (76% vs. 25%)

- More efficient capital deployment through operational involvement

- Stronger founder alignment through direct value creation

These performance differentials will accelerate as more talented managers adopt the studio model, bringing sophisticated operational expertise to early-stage venture building.

Catalyzing Structural Change

The emerging manager pivot to venture studios will drive three transformative effects:

- Value Chain Recalibration

- Shift from pure capital allocation to integrated venture building

- Evolution of success metrics beyond paper valuations

- Development of new LP relationship models based on operational capability

- Creation of alternative liquidity mechanisms

- Market Gap Resolution

- Systematic addressing of sectors ignored by Cartel focus

- More efficient deployment of capital through operational oversight

- Better alignment between capital and actual value creation

- Reduced reliance on artificial growth metrics

- Ecosystem Transformation

- Emergence of new networks outside Cartel control

- Development of alternative funding sources

- Creation of more sustainable company-building practices

- Evolution of founder preferences toward operational support

Venture Studios as Market Correction Mechanism

This transition will serve as a natural market correction to Cartel inefficiencies. By combining capital deployment with direct operational involvement, venture studios resolve the principal-agent problems inherent in traditional VC while creating more sustainable paths to value creation.

The studio model's emphasis on systematic de-risking through operational excellence provides a compelling alternative to the Cartel's portfolio concentration approach. This represents a return to fundamentals-driven venture building versus the financial engineering that has come to dominate traditional VC.

Impact on Industry Structure

The venture capital industry appears poised for significant structural change in 2025. While traditional firms continue consolidating capital and focusing on narrow themes like AI, growing inefficiencies create opportunities for alternative models, particularly venture studios. This transition represents a cyclical shift and a fundamental recalibration of early-stage innovation financing and support.

The venture studios model will become more prominent as the investing ecosystem gains more awareness of superior returns while addressing market gaps. As the industry evolves, those able to combine operational expertise with systematic venture-building processes will be best positioned to capitalize on the opportunities created by current market distortions.

References:

- Pitchbook Data. (2024). US VC Fundraising 2024: Concentration and Dominance. Highlights the growing capital concentration among top venture capital firms, with over 50% of U.S. VC funds raised by nine dominant players.

- Pog, M. Big Startup Studio Research 2024. Venture Studio Family.Inniches. (2024). Venture Studio Trends and Performance Metrics 2024. Analyzes the superior IRR performance of venture studios compared to traditional VC models, the resilience of hybrid studio models, and the role of studios in addressing early-stage funding voids.

- Cowan, J. (2024). The Power Law Cartel. Retrieved from https://www.johncowan.online/power-law-cartel/. Discusses the systemic impact of capital concentration in venture capital, critiquing the reliance on power law dynamics and its influence on the venture ecosystem.

- Ernst & Young. (n.d.). Venture capital investment trends. This report explores key trends in venture capital investments, highlighting shifts in industry focus, emerging markets, and evolving strategies among investors.

No spam, no sharing to third party. Only you and me.

Member discussion