Ventue Studio

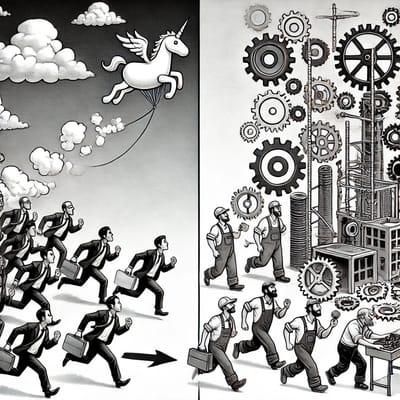

Sign up for the Founder's Program, a private advisory program led by John Cowan, designed for founders, studio operators, and early-stage CEOs navigating complex capital raises, board dynamics, and alternative financing structures.

Get capital-ready with deal formation support, 506(c) raise prep, investor communication strategy, and regular 1:1 sessions.