The Power Law Cartel in Venture Capital

In the hushed confines of a sleek Silicon Valley boardroom, a somber mood prevails among the founders and directors of a venture capital (VC) backed startup. They are about to make a decision that once seemed unthinkable: shutting down a Unicorn, a startup once valued at over $1 billion. For the employees, it's a sudden and stark transition from high-octane growth and dreams of changing the world to the sobering reality of unemployment and uncertainty. The emotional toll is heavy, marked by feelings of loss, disillusionment, and anxiety.

This grim reality has played out among several high-profile VC-backed Unicorns in recent history, exposing the delicate dance between ambition and sustainability in startup culture.

A lot of ink was spilled in the post-mortem analysis of these startup failures. But the common dynamic they all share is raising too much money too quickly, a symptom of a failing venture capital investment thesis predicated on investing billions in startups in order to prop up "marks" that are the cornerstone of their own pitch for more money from Limited Partners (LPs).

The Consequence of Unicorn Extinction

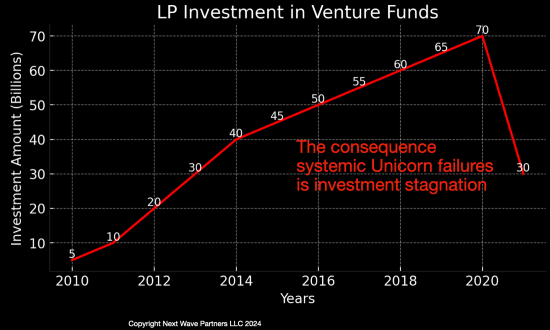

Witnessing the implosion of the old guard in venture capital might be wildly entertaining if not for the profound implications it holds for the VC asset class and the economy at large. LPs, the investors in these venture funds, find themselves in a financial quandary. The diminishing success rate of Unicorn investments leads to a lack of liquidity, making LPs hesitant to invest further in venture funds. This scenario is emblematic of the stagnation in early-stage innovation and poses a significant challenge to the ecosystem that depends on the vibrancy of this asset class.

The Challenge of Change

The relationship between LPs, founders, and VCs is complex and, in many ways, resembles a cartel – a consortium that holds disproportionate power and influence. This 'Power Law Cartel', as I call it, dominates the landscape of venture capital and innovation.

Typically, a cartel is a spoken or unspoken agreement among competing firms to control prices, production, and distribution of products. In the VC world, this translates to control over capital, access to promising startups, and influence over market trends.

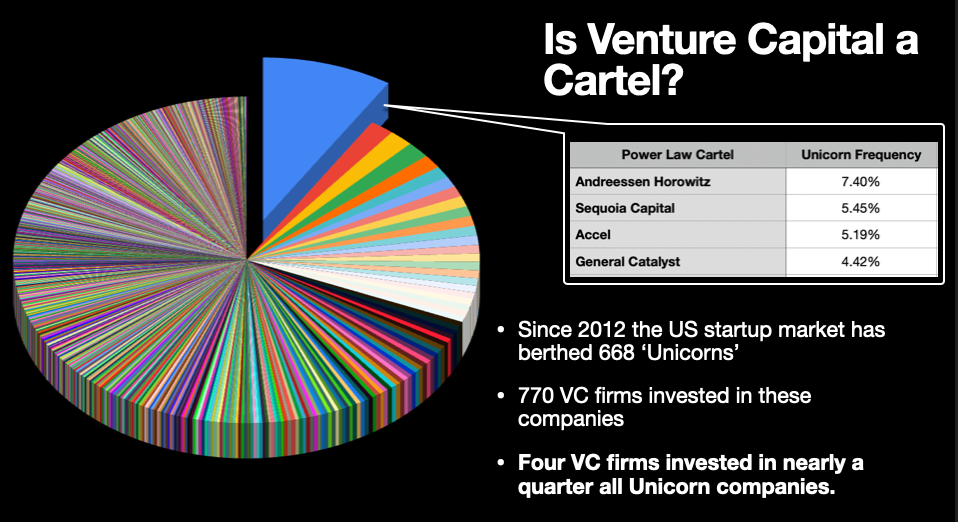

I recently analyzed the investment patterns in Unicorn companies and the data paints a peculiar scene. Since 2012, the U.S. market has seen the emergence of 668 Unicorns. These companies have been the beneficiaries of investments from 770 venture capital firms. At first glance, this appears to be a sign of a vibrant and diverse investment market. However, a closer examination reveals a different story: Just four VC firms – Andreessen Horowitz, Sequoia, Accel, and General Catalyst – have dominated nearly a quarter of the Unicorn market.

These 'four horsemen of the Power Law Cartel' exert immense influence over the direction and dynamics of venture capital and startup growth.

The Power Law Cartel: Tactics and Impacts

Is 'cartel' too strong of an adjective? Maybe. But consider their investment strategies and market behaviors.

Aggressive Fundraising and Investments: These firms raise substantial funds and invest aggressively in startups, often leading funding rounds and setting pricing precedents - a key requirement dictating or controlling the portfolio mark-to-market valuations.

Board Representation: By securing board seats, these VCs exert significant influence over strategic decisions, often prioritizing rapid growth and scale over profitability or sustainable business models. Board representation has become a standard requirement in every venture capital term sheet.

Market Signaling: Investments by these firms serve as a market signal, attracting other investors and to create the effect of a market bubble. This can inflate valuations and create market distortions. Marc Andreessen, the founder of Andreessen Horowitz, is clearly the Pablo Escobar of the Power Law Cartel. Andreessen’s market signaling has been overt and purposeful and perfectly executed. In 2023 I chronicled exactly how this played out in the crypto market, a key sector signaled by Andreessen in 2014.

Control over Exits: These firms often play a pivotal role in determining the exit strategy for startups, whether through IPOs or acquisitions, thus influencing returns for themselves and other investors. The legal mechanism of the Cartel is the stipulation of “Protective Provisions” as a condition of investment. Protective Provisions stipulate that no material decision can be made by the Company without the majority of the VC voting interests. These same rights are exerted if the VC Board member conversely wants to pursue a self-dealing transaction.

Networking and Influence: Their extensive networks and influence in the tech industry can make or break startups, creating a paralyzing dependence that can skew market dynamics. Startup founders have all but become indentured servants to the VC class. The message is clear. You must go through the Cartel, play by their rules, and pay their prices if your innovation needs capital to grow and commercialize.

The Future of Venture Capital

This concentration of power and influence raises several concerns. First, it has created an ecosystem where innovation and entrepreneurship are heavily influenced, if not dictated, by a few dominant players. This stifles diversity in ideas and business models, as startups, in Pavlovian fashion, tailor their strategies and their message to meet the expectations of the Cartel.

Second, it leads to a homogenization of investment strategies, with a focus on creating Unicorns at all costs. This approach often overlooks the fundamental aspects of building sustainable businesses, such as developing a loyal customer base, creating a viable product, and establishing efficient operations.

Third, the focus on creating and sustaining Unicorns has led to inflated valuations, often detached from the companies' actual performance or market potential. This creates a bubble-like environment, where startups are pressured to grow at an unsustainable pace, leading to burnout, layoffs, and, in some cases, complete shutdowns. And even if these companies are fortunate enough to make it to the public markets (IPO), retail investors are often left holding an empty bag.

The current state of venture capital, dominated by the Cartel, necessitates a reevaluation of investment strategies and market dynamics. There is a need for a more balanced approach that values sustainable growth, profitability, and long-term viability over the relentless pursuit of high valuations and rapid scale.

An Open Letter to LPs

The extinction of the Unicorn is a poignant reflection of the real-world dynamics in the startup ecosystem. It underscores the need for a paradigm shift in venture capital – from a singular focus on creating Unicorns to fostering a diverse portfolio of sustainable, profitable businesses. This shift requires a rethinking of the fundamental principles that have guided venture capital investment strategies, which have forced you into doing business with the Cartel.

Firstly, rebalance GP incentives. Rather than pouring billions into a handful of VCs to perilously gamble on potential Unicorns, your investment allocation would benefit from spreading investments across smaller funds. This approach forces venture capital funds to rely much more on success-based metrics carried interest rather than management fees.

Secondly, the focus on your returns should shift from rapid scale to sustainable revenue growth. Startups need to be encouraged to develop solid business foundations – robust revenue models, efficient operations, and strong customer relationships – rather than prioritizing breakneck growth to achieve Unicorn status.

Thirdly, eliminate the obvious VC conflicts of interest. VC investors should not be appointed to the Board of Directors of portfolio companies. It is impossible for an investor to simultaneously exercise fiduciary responsibility, on one hand, and represent the interests of their fund, on the other.

Finally, institutionalize transparency and accountability between founders and investors. Standardizing the practice of corporate governance, reporting, and investment relations will lead to a more healthy and productive relationship between the funds you invest into and portfolio company leadership. The truth is that not every company should be perpetually funded, and investors should make those decisions based on the entirety of information. Ironically, it is the founders that will benefit most from this.

The current challenges facing Unicorns and the broader venture capital market presents a rare and unique opportunity. This is a chance to recalibrate and create a more sustainable and resilient startup ecosystem. The goal should not be to eliminate the pursuit of high-valued so-called Unicorns, but to foster a balanced approach that recognizes the value of varied business models and paths to success.

Successful investors and successful founders share common DNA. We work on the same set of data as everyone else but see and act upon opportunities that others haven't noticed yet. We understand that the greatest gains are often found not in the full light of day, but in the shadows, long before the dawn breaks for the rest of the market.

Together we can reshape the landscape of venture capital and foster an ecosystem that thrives on innovation, resilience, and shared success. The time for change is now.

No spam, no sharing to third party. Only you and me.

Member discussion