The Extinction of Venture Capital as We Know It and the Rise of the Venture Studio Business Model

Venture capital (VC) firms are forecast to raise less than $200 billion in 2024, a 48% decline from 2021 levels according to Pitchbook. Fundraising is only expected to grow 2.9% annually through 2028, less than half the rate of other private capital strategies, including private equity, private debt, and real assets funds. Grimmer still, the Venture Capital Journal's annual survey of Limited Partners (LPs) revealed the proportion of LPs looking to add VC managers to their investment portfolio plummeted to just 30%, down a heart-stopping 36 points from just two years ago.

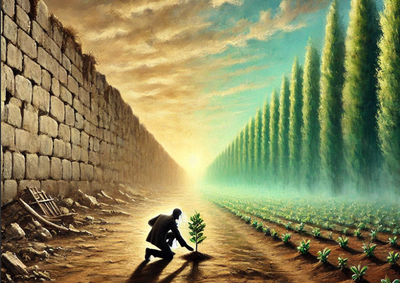

Perilously stuck in neutral, seemingly unable to go back to the well with the same old pitch to LPs for more and bigger funds that rake more fees regardless of performance, the VC industry may very well be on the brink of extinction.

Behind the data scenes, the meteoric arrival and maturity of the Venture Studio model is accelerating this extinction. As this trend intensifies, venture studios could become the new industry standard in the years ahead, replacing the contemporary VC at the top of the innovation food chain.

Significant inefficiencies, including high failure rates and resource-intensive fundraising processes, sow the seeds of extinction. Current research suggests the average failure rate for seed-stage startups is a depressing 86%. To counteract that statistic, traditional VCs spread their investments across a broad portfolio, hoping for a few successes to offset the many failures. This high-risk approach is inherently inefficient and results in substantial resource wastage. I have previously described this as the "Power Law" investing thesis, where VCs exclusively aim to find and fund unicorns—startups valued at over $1 billion. This approach leads to irrational valuations and a lack of genuine innovation as firms focus on scaling a few high-potential companies at the expense of broader, more sustainable growth.

In stark contrast, a venture studio is an organization that creates startups internally or works with early-stage projects to develop them into successful companies systematically. Studios aim to mitigate risks through rigorous testing and iteration, leveraging a structured process to validate ideas before funding and scaling them. They also maintain a hands-on role in the startups' daily operations, ensuring alignment and increasing the likelihood of success.

Recent study data reveals that studios achieve a 44% improvement in company success rates and reduce the time to raise growth funding compared to traditional startups. This systematic risk mitigation leads to higher success rates and more efficient resource use.

The Importance of Information Superiority

Venture studio operators are deeply involved in the daily operations and strategic decision-making of the startups they create or advise. This involvement results in more significant information superiority, enabling smarter investment decisions. By being embedded in the startup’s operations, studio operators understand the market, technology, and competitive landscape comprehensively. Traditional VCs, constrained by their distance from daily operations, cannot match this level of insight. This deeper involvement allows venture studios to identify and address potential issues early, further enhancing the likelihood of success.

Consider the case of Atomic, a prominent venture studio that has successfully launched numerous companies such as Hims & Hers and Bungalow. Atomic's model involves rigorous market analysis and continuous feedback loops with their startups, enabling them to pivot quickly and effectively. This hands-on approach has allowed them to scale businesses rapidly while minimizing the risks associated with early-stage ventures. In contrast, traditional VCs often lack this granular level of involvement, relying instead on periodic updates and board meetings, which can miss critical early warning signs.

This deep involvement contrasts sharply with the Power Law investment approach, focusing on finding and scaling unicorns rather than fostering sustainable growth across a more diverse portfolio of companies.

Leveraging Experienced Founders More Effectively

Venture studios create an environment allowing experienced founders to leverage their skills and knowledge fully. Traditional VC firms have long attempted to integrate experienced founders into their practice. Some call them “Entrepreneurs in Residence.” However, experienced founders trying to do what they do within the traditional VC firm structure are often stunted by the "2 & 20" fee structure model, which prioritizes short-term gains over long-term growth. In contrast, venture studios provide a supportive framework that aligns the interests of founders and investors toward achieving the best outcomes.

Human Ventures, a New York-based venture studio, exemplifies this model by bringing on board seasoned entrepreneurs and providing them with the resources and operational support needed to develop their ideas. Human Ventures has successfully launched companies like Tiny Organics and The Kin, demonstrating the effectiveness of leveraging experienced founders within a venture studio framework. These founders benefit from the studio's extensive network and expertise, which significantly increases their chances of success compared to the more isolated environment of traditional VC-backed startups.

Superior Financial Performance

Financial performance is a critical metric for evaluating the effectiveness of any investment model. It was recently revealed that venture studios achieve an average internal rate of return (IRR) of 53%, more than double the 21.3% average for traditional venture funds. This superior performance is driven by lower failure rates, efficient capital use, and the ability to scale successful companies more quickly. Logic dictates that a model yielding higher returns with lower risk and greater efficiency will attract more investors over time.

In contrast, traditional VC often fails to deliver consistent returns, with many funds underperforming and only a few yielding significant returns. This inconsistency is becoming increasingly unacceptable to limited partners (LPs), leading to a massive and unprecedented retreat from venture capital firms.

Science Inc., a venture studio based in Los Angeles, has demonstrated superior financial performance through its structured approach to company building. By focusing on digital media and consumer goods sectors, Science Inc. has created successful companies such as Dollar Shave Club, which Unilever acquired for $1 billion. This exit provided significant returns to its investors and validated the venture studio model's ability to generate consistent and substantial financial outcomes. Such success stories are becoming more common among venture studios, highlighting their potential to outperform traditional VCs.

Eventually, LP investment dollars will find a new home in the venture asset class. Venture studios, with their higher IRR and more predictable outcomes, offer a compelling alternative. LPs will increasingly pressure the market to adopt models that deliver greater and more consistent returns, further driving the shift towards venture studios.

The Time is Now: The Surge in Venture Studios

Leading venture studio researcher Max Pog highlights the rapid emergence of venture studios in recent years as evidence that change has already begun. According to Pog, the number of venture studios has grown significantly, with more than 500 studios now operating worldwide. This growth reflects the increasing recognition of the venture studio model's advantages and the shift in investor preferences towards models that offer higher returns and lower risks.

Pog's research provides a detailed account of the venture studio landscape, showing the proliferation of studios in key innovation hubs such as Silicon Valley, New York, and Berlin. Studios like Betaworks in New York have been at the forefront of this trend, creating successful companies such as Giphy and Bitly. This rapid expansion and the success of these studios serve as a testament to the growing acceptance and effectiveness of the venture studio model, indicating a fundamental shift in how startups are built and funded.

The venture capital landscape is at a crossroads. Traditional VC firms, much like the dinosaurs, must evolve and adapt or face extinction. The deep involvement of studio operators in startups, superior risk mitigation, effective leveraging of experienced founders, and higher financial returns strongly suggest that venture studios are poised to become the new standard in venture investing in the years ahead. As LPs demand more consistent and higher returns, traditional VC models will face increasing pressure to adapt or perish. With its proven track record and superior business model for investing, the venture studio model is leading the way in this transformation, ultimately forcing the extinction of traditional venture capital as we know it.

If existing VCs don’t evolve to survive in this new era, they will undoubtedly be left behind.

No spam, no sharing to third party. Only you and me.

Member discussion