Vanishing Equity: The Financial Sorcery of Venture Capital

In the entrepreneurial journey, securing venture capital (VC) funding is often seen as a hallmark of success. However, the influx of capital comes with complex terms that can significantly impact Founders' control and equity in their own companies.

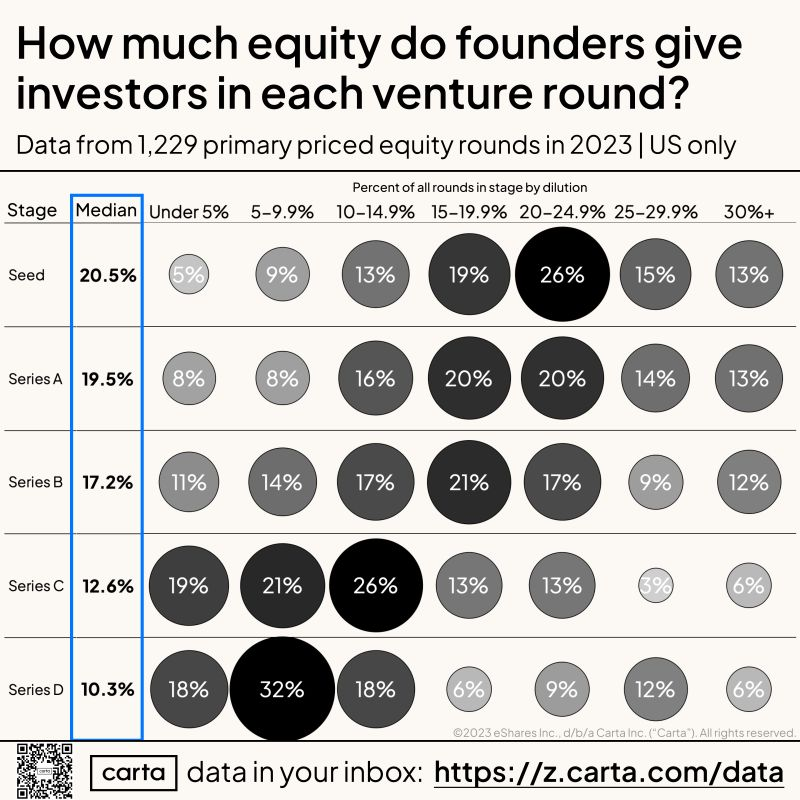

Carta revealed in 2023 that over four successive venture capital rounds of financing, Founders will part with over 80% of their equity. And that is just the median value derived from 2023. I predict this will get much worse for Founders in the wake of financial carnage created by the Power Law Cartel's failing Unicorn investment strategy.

How does this happen?

The following analysis tells the tale of how venture capital firms can achieve this level of equity transfer through the experience of a hypothetical startup, "TechNova," navigating its first major funding round.

TechNova's Funding Round: A Hypothetical Scenario

TechNova, a promising tech startup, has emerged from its stealth boot-strapping stage and is looking to raise $5 million to accelerate its product development and market expansion. After hundreds of pitches, the Founders attract a VC firm interested in investing the entire amount. The term sheet includes some confusing terminology, including liquidation preference multiples, accrued interest, board representation, protective provisions, and preferred share voting rights. But, the ascribed value is $20M (Pre Money Value) - and that is a number that feels very generous and validating to the Founders.

Doing the simple math, the Founders agree it is a good deal to sell a 20% stake in their business for $5M.

And so they sign the term sheet.

Understanding How the VC Encroaches the Equity Position of Founders

- Liquidation Preference Multiples: The VC firm negotiates a 2x liquidation preference. This means that in the event of a sale or liquidation, the VC will receive twice their investment ($10 million) before any other shareholders receive proceeds. For TechNova, this will significantly reduce the potential payout to Founders and early employees in a successful exit scenario. But at this stage, it is very hard to see.

- Accrued Interest: The term sheet says the principal investment amount will accrue interest at an annual rate of 8%. This interest adds to the principal amount that will convert into equity at a later date, thereby increasing the effective ownership stake of the VC and diluting the Founders further when the conversion occurs. A successful startup could be around for more than six years before exiting. 8% is going to pile up.

The Entrenchment of Control Through Governance Terms

- Board Representation: The VC firm secures two seats on TechNova's five-member board. Throughout the discussions and due diligence, the lead Partner from the VC firm has insisted that they 'just want to be helpful' and that, unlike other VC firms, they offer tremendous 'intangible value' to Founders. But this strategic move gives the VC significant influence over company decisions, from strategic direction to financial management to deciding to terminate the Founders! All of this will come into play later when real money is on the line.

- Protective Provisions: The term sheet includes protective provisions that require the VC's approval for a range of major decisions, such as raising additional funding, altering the company's business model, or selling the company. The VC tells the Founders that these terms are really just to mitigate risks. But in truth, these provisions effectively handcuff the Founders, limiting their ability to make autonomous decisions.

- Preferred Share Voting Rights: The VC's investment is in preferred shares, which carry superior voting rights compared to the common shares held by Founders and employees. This disparity in voting power further cements the VC's control over TechNova, making it almost impossible for the Founders to push through decisions without investor consent.

TechNova's Journey Post-Investment

As TechNova progresses, the interplay of these terms begins to manifest. The accrued interest increases the amount of equity the VC is entitled to, diluting the Founders' and early employees' shares. Simultaneously, the VC's board representation and protective provisions ensure that the investors have a decisive say in the company's strategic direction, leaving the Founders with diminished control over decisions. After about the first year or two, the Founders begin to realize they have become sharecroppers in the innovation business.

As startups go through successive rounds of capital, the process of Founder dilution compounds. Each funding round typically involves the issuance of new shares to investors, which dilutes the ownership percentage of existing shareholders, including Founders.

The Compounding Effect of Successive Financing Rounds

New shares are issued to new investors, further diluting the Founders' ownership. The compounding effect comes into play because the dilution in each round is based on the post-money valuation of the previous round. As the valuation increases with each round, the issuance of new shares has a greater impact on the Founders' ownership percentage.

Were TechNova to raise another $5M with a valuation increase to $30M pre-money, let's calculate the dilution example:

- Pre-money valuation: $30M

- New investment: $5M

The post-money valuation would be the sum of the pre-money valuation and the new investment:

- Post-money valuation: $30M + $5M = $35M

To calculate the Founder's ownership percentage after the new funding round, we need to consider the Founder's ownership percentage before the round and the post-money valuation:

- Founder's ownership percentage before the round: 80%

- Founder's ownership after the round: (Founder's ownership before the round * Pre-money valuation) / Post-money valuation

Plugging in the values:

- Founder's ownership after the round: (80% * $30M) / $35M = 68.57%

Therefore, if TechNova had to raise another $5M with a valuation increase to $30M pre-money, the Founder's ownership percentage would decrease to approximately 68.57%.

This process continues with each successive funding round, resulting in a compounding effect of Founder dilution. Even in the best market conditions, the Founders' ownership percentage gradually diminishes, as new investors come in and the company's valuation increases.

Paying the Piper

But let’s pretend TechNova doesn’t compound dilution with follow on venture investment. And let's further assume the Founders are not a Wasserman statistic after the first three years. After 4 years of 80 hour work weeks and an indescribable emotional roller coaster, TechNova is sold for a respectable $50 million acquisition price. To the Founders, this feels like a win. To think that another firm considers what you built to be worth that sum of money is emotionally validating.

But now it is time to calculate the real impact of venture capital.

To calculate the net percentage of the $50M liquidity event returned to TechNova’s venture investor, we must calculate the total preferred return to the investor due to the liquidation preference and accrued interest, and then determining what percentage of the total liquidity event ($50M) this return represents, add on the portion attributable to the original shareholding.

The calculations break down like this:

Accrued interest over 4 years: $1,600,000

Total amount due (initial investment + accrued interest): $6,600,000

Total preferred return (with 2x liquidation preference): $13,200,000

Net amount attributable to the initial share allocation from the remaining proceeds: $7,360,000

Total amount returned (preferred return + net amount from share allocation): $20,560,000

To calculate the net percentage of the $50M liquidity event returned to an investor, we use the total amount returned ($20,560,000) and divide it by the total liquidity event value ($50M), then multiply by 100 to get the percentage.

Like master magicians, TechNova’s VC turns their 20% stake of a $50M liquidity event into 41.12%! That's right, a jaw-dropping increase of over 100% in return, all without the VC ever having to invest a single additional dollar beyond their initial investment.

Concluding Reflections: Navigating the Venture Capital Paradox

The venture capital model reveals a paradox that defines the startup investment landscape. The rationale behind the seemingly egregious terms imposed by venture capitalists becomes clearer when viewed through the lens of their operational imperatives.

VCs operate in a high-stakes environment where the success rate of investments follows a power law distribution, meaning a small number of investments yield disproportionately high returns while the majority underperform or fail outright. This distribution necessitates that VCs secure as much value as possible from each investment to compensate for the inherent risks and to ensure the overall viability of their portfolio.

Consider a theoretical returns distribution of a typical VC fund. In this model, if a fund invests in 100 startups, perhaps only one or two might have "Unicorn potential," companies valued at over $1 billion, generating returns that can be 50 times the initial investment or more. Another handful might yield moderate returns, while the vast majority will likely result in partial recoveries or total losses.

In financial terms, if the fund invests $100 million across various startups, the expectation might be to turn this into $300 million over a certain period. Following the power law, if one investment returns $200 million (a 20x return on a $10 million investment in a Unicorn), it significantly offsets losses or modest gains from other investments. However, Unicorns are rare, and relying solely on these outliers is a gamble. Therefore, VCs must implement terms that ensure they can achieve substantial returns even from non-Unicorn investments, which are far more common.

I don't want to give the wrong impression about Venture Capitalists as human beings. I have worked with some that are genuinely decent people. But even the good ones cannot avoid their own traps. They end up making irrational, some times draconian, decisions because the pursuit of investment returns predicated on a skewed distribution all but assures the necessity to egregiously extract value from investments like TechNova that do see a degree of material liquidity.

The Implications for Founders

For Founders like those at TechNova, this means navigating a landscape where their investors are playing a high-stakes game, aiming to maximize returns from every possible avenue. The complex terms and control mechanisms are clever strategies designed to insulate the venture fund against its own bad investment decisions.

These terms are a reflection of the economic realities of venture investing, where the insanity of pillaging the equity of the few successful must pay for the underperformance or failure of many.

If the venture fund paradigm shifted towards aiming for modest but far more consistent returns (see my earlier analysis of Longtail theory), a transformative balance could be struck, fundamentally altering the distribution of success and rewards within the startup landscape.

I am pursuing an alternative approach to venture funding, adopting investment strategies that prioritize steady, reliable growth over the high-risk, high-reward pursuit of the next Unicorn. By focusing on achieving moderate returns across a broader spectrum of investments, I believe I can systematically reduce or eliminate the pressure to impose stringent terms on startups to underwrite my own poor performance as a fund manager.

Over a series of future articles I will reveal how, mathematically, returning the vast majority of profit from the sale of a startup to the people that conceived and built it is actually better for venture capital firms.

No spam, no sharing to third party. Only you and me.

Member discussion